COLUMBUS, Ohio (WCMH) — Franklin County home values are expected to increase more than 40% from this year’s mass reappraisal, with even higher jumps for Canal Winchester, Reynoldsburg and Whitehall.

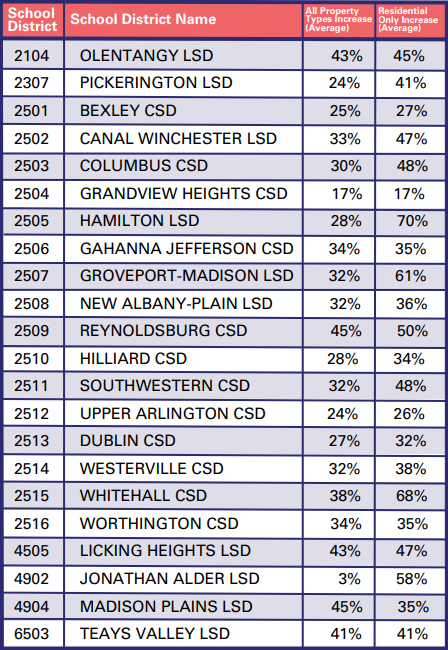

The state-required reappraisal process has released tentative new evaluations that increase Franklin County residential values by an average of 41%, according to county Auditor Michael Stinziano. Broken down by school district, the increases range from a 17% increase for Grandview Heights to a 70% increase for Hamilton Local School District.

Canal Winchester and Licking Heights can expect an increase of 47%, Columbus City Schools a 48% increase, Reynoldsburg a 50% increase, Groveport Madison a 61% increase and Whitehall a 68% increase.

How will the increase impact taxes?

Property taxes are calculated by multiplying the taxable value of a home (35% of the assessed value set by the county auditor) times the effective tax rate designated by the home’s district. The primary variable in the equation is the district’s tax rate that varies across central Ohio based on ballot box issues, like school levies.

So, it is not a one-to-one ratio: A 41% rise in property value does not equate to a 41% increase in taxes, the auditor’s office said.

Counties are required to reappraise real estate every six years — the process underway in Franklin County — and update their values every three years. Along with Franklin County, Delaware, Licking and Pickaway counties are completing reappraisals in 2023. Ashland, Athens, Knox, Madison and Noble counties are updating.

The reappraisal process is much more intensive, while a three-year update only assesses home sale data. Stinziano’s office noted Franklin’s County’s last update in 2020 increased values roughly 20%, leading to a tax increase of about 7.8%.

How to track the reappraisal process in Franklin County

The auditor’s office launched a “one-stop shop” site earlier this year to ensure the process is transparent and accessible for homeowners. Titled the 2023 Know Your Home Value, the site displays an interactive timeline of the reappraisal process through December.

The timeline shows that the auditor’s office sent the new proposed property values to the Ohio Department of Taxation in May before releasing tentative values. Proposed values of each individual property will be available for review online on Aug. 8 and mailed to owners later in the month.

Owners who disagree with the assigned value can meet with the auditor’s office through September before property values are set in December. Answers to frequently asked questions and the ability to request an auditor’s office speaker who can explain the process to neighborhood groups is also available on the site.

The auditor’s office is holding “Reappraisal Exhibitions” across the county to illustrate the process to property owners and answer any questions. These exhibitions will feature interactive displays highlighting the reappraisal process, how it happens and what components go into a reappraisal as well as different services, functions and resources that are available to property owners through the auditor’s office.

The next exhibition is scheduled for Aug. 2 at the Parsons Branch of the Columbus Metropolitan Library from 5:30 to 7:30 p.m. Additional dates and locations for exhibitions will be announced soon.