COLUMBUS, Ohio (WCMH) — More tariffs went into effect at midnight on Tuesday, and experts said Ohioans can expect price increases.

Trump enacted sweeping tariffs on April 2 for many countries, and 86 trading partners had tariffs go into effect at 12:01 a.m. on Wednesday, including a 104% tariff on China. China’s retaliatory 34% tariff on the U.S. will go into effect April 10. These tariffs, or taxes on goods made outside of the U.S., are predicted to raise prices for Ohioans and markets across the world. Tariffs generally raise prices for companies, which then decide whether to pass those on to consumers.

Yale’s Budget Lab has examined the state of U.S. tariffs, updating their estimates on Tuesday. According to the Budget Lab, the average household is expected to lose $3,800 in tariff price increases. Ohio State University chairperson of agricultural marketing, trade and policy Ian Sheldon said clothing, food, sports goods, transportation goods, electronics, alcohol and household goods are all likely to see price increases. See previous coverage of tariffs in Ohio in the video player above.

“They tend to hit people on the lower end of the income distribution compared to those on the higher end of the income distribution because lower-income consumers tend to buy more what we call traded goods, whereas higher-income consumers, traded goods are a lower proportion of their income,” Sheldon said. “They tend to spend more of their income on what we call services.”

The Yale Budget Lab estimates households in the bottom 20% — averaging $1,700 in disposable income each month — will lose nearly 4% of their income. The Budget Lab compared this to 1.6% losses in the top 10% of earners, or those who make at least $8,000 in disposable income each month.

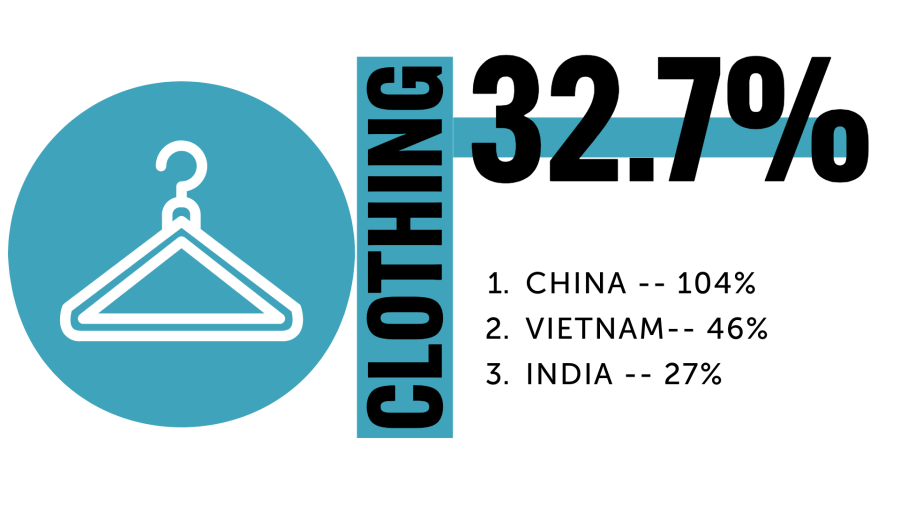

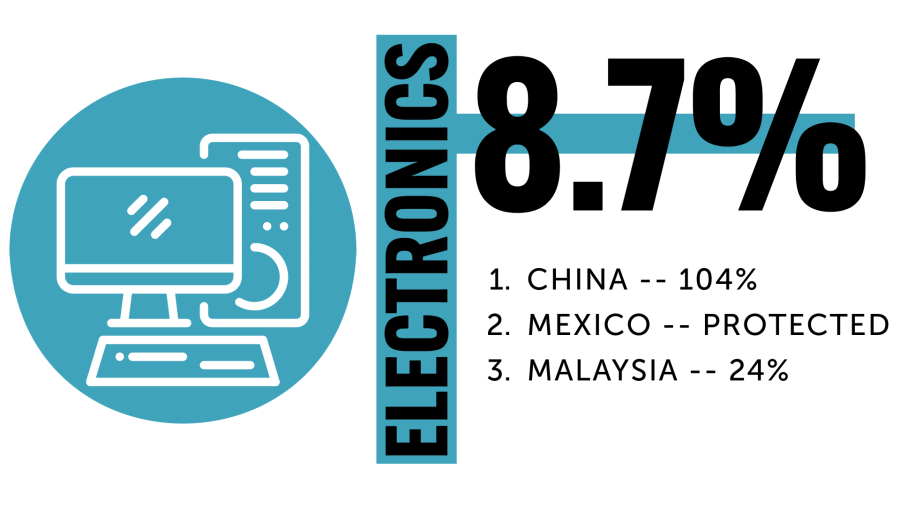

Sheldon predicts food items like shrimp, coffee and chocolate will all increase, as these goods are largely grown outside of the U.S. In all, the Budget Lab lists 65 traded good sectors that have been affected in the last week, including leather products, fishing, wood and pharmaceutical products. NBC4 broke down some of the examples analysts are predicting will see large increases, as well as the top three countries of import and their relative tariffs.

Clothing costs are predicted to increase significantly, as only 3% of clothing sold in the U.S. is made domestically. Three-fourths of the market is dominated by production from Asian countries, among the hardest hit.

According to the federal government, the U.S. primarily gets its rice from Asia and South America. U.S. rice imports have tripled in the last 25 years, and the U.S. was the fourth largest importer of rice in 2024.

China is the top electronic manufacturer for the U.S. market. Starting on April 9, the U.S. will enact a 104% tariff rate on electronics, most likely increasing prices.

Using these percentages, general cost increases can be predicted. Ignoring any market nuances, a $20 shirt subject to an average 32.7% tariff would cost $26.54. However, these estimations are general, and will adjust from product to product.

For example, average tariff increases would see a $1,199 iPhone 16 Pro Max increase costs to $1,303.31. However, as iPhones are largely manufactured in China, CNBC predicts iPhones could increase by as much as $350. Although Trump intends to revert manufacturing to the U.S., Apple said moving iPhone manufacturing to the U.S. could double costs because of labor variations.

Although eggs can only be imported from some countries, bird flu outbreaks led the U.S. to import more than 13.5 million dozens of eggs in January and February. Trump has been proud of decreasing egg costs, but prices rose slightly after tariffs were enacted.

A March 31 summary of the price for one dozen eggs across six grocery stores with storefronts in Ohio — Walmart, Target, Aldi, Kroger, Giant Eagle and Meijer — found a carton of eggs averaged $4.93 across stores. An April 8 price comparison of those same six stores found one dozen eggs now costs $5.31 on average.

Trump warned there will be growing pains with these tariffs, but Sheldon cautioned he and other economists are not optimistic about long-term tariff success.

“We’re not convinced it’s going to reduce the U.S. trade deficit,” Sheldon said. “Most of us are not sure about how much tariff revenue it’s actually going to raise, because the more you raise tariffs, and the higher you raise tariffs, demand tends to decline. So it’s not clear that the administration can raise the amount in tariff revenue that it thinks it is going to raise.”

The Yale Budget Lab said it is likely tariffs even out among income brackets over time, but it is otherwise difficult to predict long-term effects. Assuming nothing in the market changes, tariffs have no impact on consumers’ behaviors and inflation is stagnant, the Lab said tariffs would likely raise $3 trillion for the U.S. government by 2035. However, if the Lab factors in market predictions from the Congress Budget Office, it’s more likely the U.S. would lose $588 billion in the next 10 years.