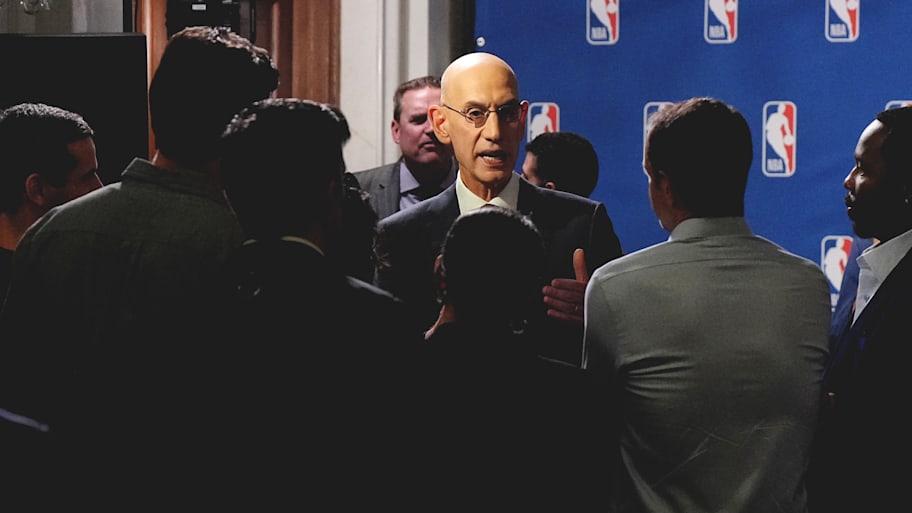

Among the things Adam Silver expected to be dealing with in his 12th season as NBA commissioner, an alleged case of salary cap circumvention involving one of the NBA’s best players, its wealthiest owner and a bankrupt climate-conscious financial services company wasn’t one of them. At least not until an episode of the Pablo Torre Finds Out podcast implicated Clippers owner Steve Ballmer in an alleged scheme to skirt salary rules by funneling money through a firm that sold carbon offsets before the company went belly-up. (Ballmer denies the team circumvented the cap.) “This was not something that was on our radar,” says Silver. “We will get to the bottom of it.”

While Silver has shifted the Clippers’ case to Wachtell, Lipton, Rosen & Katz, its go-to law firm for sticky investigations, he still has plenty on his plate. The league’s new national broadcast deal has fans scrambling for channel guides. The failing of regional networks has more reaching for their wallets. Internally, the NBA continues to debate the value (or lack thereof) of expansion, the future of the All-Star Game and how to keep sports gambling from infecting the integrity of the game. Silver addressed all that and more in his annual State of the NBA sit-down with Sports Illustrated.

Sports Illustrated: You said you wanted to see the “totality of the evidence” before making any judgment on whether or not the Clippers intentionally circumvented the salary cap. Some team executives are asking what you need to see to determine if the team cheated?

Adam Silver: Somebody asked me if circumstantial evidence is enough, and just as in a court of law, sometimes there’s direct evidence and sometimes there’s circumstantial evidence. And certainly, circumstantial evidence alone doesn’t prevent findings for one particular side. But then, even in the case of circumstantial evidence, you look at the totality of the circumstances. So it’s not formulaic. We will look at everything that’s presented to us, and that includes inferences that come from evidence as well.

SI: Do you expect this to be a long investigation?

AS: I really don’t know. I can say it will take some time, just based on past experience. From the reporting so far, many of the sources are anonymous, but there are several of them. And you have here a separate court proceeding. We have a guilty plea [by Aspiration cofounder Joe Sanberg for wire fraud]. So there’s a fair amount of evidence for us to look at. The stakes are very high here. We, as a league, want to be careful and make sure that not only are we being fair to the Clippers and Steve Ballmer, but also that we have a true understanding of whatever happened here.

SI: The national broadcast deal that ended TNT’s package and brought in NBC/Peacock and Prime Video was a windfall: 11 years, $77 billion. But critics—like Charles Barkley—have said that the fragmentation will be damaging. That the deal is anti-fan. What would you say to that?

AS: I accept Charles’s point that there will be disruption in the short term. I think, over time, technology is clearly our friend here. Just by way of example, through the NBA app, which is free to download, you will be able to have a front door into every game on any service that’s carrying the NBA. We recognize the transition will be an issue and for fans who are used to finding the NBA on TNT. Obviously, we won’t be there.

We need to help direct them to where our games will be located. I also think there’s an ongoing shakeout in the media industry. There will be, no doubt, additional aggregation of some of the streaming services now. I think it’s too early to conclude how easy or not it’ll be for consumers. My sense is that over time the consumer/fans generally win in a market economy. And the market and the media companies will respond to what the fans want. Because it’s of course not in our interest to create services that fans find it too difficult to subscribe to.

I don’t want to be Pollyannaish. I mean, the fact that we’re going from one paradigm that had been in place now for two decades and are going to be adding two new partners and replacing one, we’re going to have to reeducate the fans on where to find the games. Also, as part of ESPN’s app, they made a company decision that they wouldn’t only promote their own networks. This goes to the point of a competitive marketplace and wanting to be fan friendly. They want sports fans to know if a game is on Fox or a game is on CBS.

We are developing our app independent of ESPN, but no doubt we’re looking at the same market information and we’re all responding to what fans are saying loud and clear that there’s real confusion in the marketplace. I know firsthand, and I won’t pick on any particular sport that’s not mine, but I think we’ve all had that experience where we’re ready to watch the game, can’t find it and end up going to Google and saying, Where’s Game X on? Even then, it’s not always so clear. Over time I think these new technologies will be very fan friendly, but we’re going to have to work through the transition.

SI: The local TV rights are a mess. Regional networks are shutting down. Others are in bankruptcy. Others are, in your words, “teetering.” How big a problem is this, and is there a solution?

AS: It is a significant issue for the league right now. It’s been a large part of our historic business model, and for our teams, a major revenue source has been the distribution of these games in their local markets, largely through cable and satellite. Many of our regional sports networks only just emerged from bankruptcy and others are now defunct.

I’m not overly concerned, because in the same way several of the major streaming services were saying publicly only a couple of years ago that live sports were unlikely to become part of their model, they’re now all embracing it. In the same way that they’re embracing sports for national and global distribution, they will discover the value of local distribution as well. By way of example, a local game on average has twice the engagement of a national game, meaning a fan in Milwaukee or in the Bucks’ market is likely to watch a Bucks game twice as long as a fan outside of their region. As the marketplace responds to what the viewers and consumers want, there’s no doubt that these local games are highly desirable for fans in those markets.

As traditional television continues to decline, and that decline has only accelerated in the last few years, people’s default watching becomes streaming services as opposed to traditional television. They’re going to want to be able to get these games on those streaming platforms, and the streaming platforms are going to want to differentiate themselves in the marketplace by being the one that carries those local games. Lastly, I think as the marketplace just demonstrated the value of NBA games nationally, by virtue of that example I gave about in terms of engagement, there’s absolutely no reason why these games proportionally should have less value locally than they do nationally. If anything, they should be worth more locally.

SI: Could we see an NFL Sunday Ticket model? One that includes local games?

AS: Yes, conceptually, it’s very much the same thing. To me, the most pro-consumer/fan model would be one where you can get any game at any time regardless of the geography. And you would also simplify the transactional friction in terms of being able to get that game. That’s something that, I’d say, many of the national platforms are interested in and those discussions are ongoing.

My hunch is where we will end up is most likely a hybrid. A loosely comparable example would be the newspaper business. If you want to read the print version of the New York Post, it’s obviously still available. But if the print newspaper’s not available, you’ll go digitally. And I’m sure there’s a different consumer who has little interest in a print newspaper and only wants digital, because they don’t like the notion that they’re reading old news. They want it current all the time. I think you’ll likely see, in the case of our television distribution, some people who like the way it’s always been distributed—whether it’s broadcast television or cable—and others who will just want to watch games on their tablets or phones or through their televisions, but have it come in through a streaming service as opposed to a legacy way.

SI: I only read print, Adam.

AS: I know. I still smile when I see SI.

SI: Gambling is still a major issue, one that you talk about frequently. Prop bets are an issue. I know you wish NBA games didn’t have them. Have you had any discussions with gambling companies about eliminating them?

AS: We have ongoing discussions with the betting companies about prop bets. When sports betting was legalized, the NBA was not at the table, nor were the other sports leagues. These were deals that were cut between states and licensed gaming operators. We then have partners who market the NBA, and we license official data feeds, but that doesn’t give us control over how operators, including many who are not licensed by the league, choose to present bets.

And in the case of prop bets, some changes were made as a result of discussions we had, particularly around what we saw as the most high-risk cohort: two-way players who didn’t have a lot of stake in the league. We think there are other reasonable modifications that should be made on the range of prop bets that ultimately would be healthy for the industry. So those discussions are ongoing.

SI: You seemed to have pumped the brakes on expansion recently. What once seemed to be a foregone conclusion now feels like it might never happen.

AS: I have not been trying to convey through my words in media availability that we’re any less interested in potential expansion than we were two years ago. I’m just being factual. It’s a very deliberate process, and it’s something that the league, working with our teams, continues to consider and discuss. In fact, we’ve continued to build out models of both the math on expansion and potential dilution in terms of our current national television deal. What’s more difficult is at least attempting to project out to the extent we’re selling future shares in the NBA, how to value that. That work continues.

SI: So what about relocation? You have some teams with arena issues. You have teams with leases that are set to expire before the end of the decade.

AS: The answer is yes, we’re always looking at everything. We wouldn’t be doing our jobs as a league if we weren’t always thinking about how we’re doing in our existing markets. There is absolutely no intention now to relocate any particular team, but it becomes part of the discussion. I think as we look at arena situations in given markets, we look at the ebb and flow of population in the country and economic prosperity in particular markets. We always want to make sure that we are in markets that can sustain a competitive team. So yes, all those factors are in the mix.

SI: Will your plans to start a European league impact the timeline? Do you want to get that off the ground before you consider expansion or relocation?

AS: No, they are on completely independent tracks, and even different people at the league office who are thinking about the domestic expansion versus what the opportunity is in Europe. I am a big believer that there very well may be an opportunity for a viable NBA-style league in Europe. And that work is continuing. We hired JPMorgan, which is working alongside a boutique investment firm called Raine. That work is ongoing. I had several meetings in Europe this summer with interested stakeholders, but we view that project as completely independent of domestic expansion, and our owners do as well.

SI: Finally, the All-Star Game. Another new format this year, with the U.S. against the world. If this doesn’t work, are you ready to take the game behind the barn and shoot it?

AS: I’m not ready to give up.

SI: But what makes you think this latest change is going to work?

AS: I would say, in all seriousness, the changes over the last few years were more incremental. This is a wholesale [change] what we have on the table now. This Ryder Cup format is a wholesale different approach. I think what’s also changing, of course, is the media partner. The game will be back on NBC and will be smack in the middle of the Winter Olympics. I think we will be the beneficiaries of a lead-in of Olympic competition, and then we will be passing back to other Olympic competitions. It’s my hope that that will put the players in the mood for this international Ryder Cup–type format.

I also believe that the players recognize what’s at stake here, too. There’s always been something special about the NBA All-Star Game. There’s an entertainment aspect, but of course our fans want to see players playing basketball passionately. I think the players understand that. It’s a tradition I believe is worth saving. I know the players association does, too. I’m hoping that the fact that we’re back on NBC with John Tesh’s music will allow us all to reminisce about the old days of fun All-Star Games and that we’ll have a successful one this year.

SI: You do know the definition of insanity, Adam …

AS: I know. And I know I say this every year. I hope this works.

More NBA on Sports Illustrated

Listen to SI’s NBA podcast, Open Floor, below or on Apple and Spotify. Watch the show on SI’s YouTube channel.

This article was originally published on www.si.com as Adam Silver on the Clippers Scandal, NBA Expansion and the Future of Watching Games.